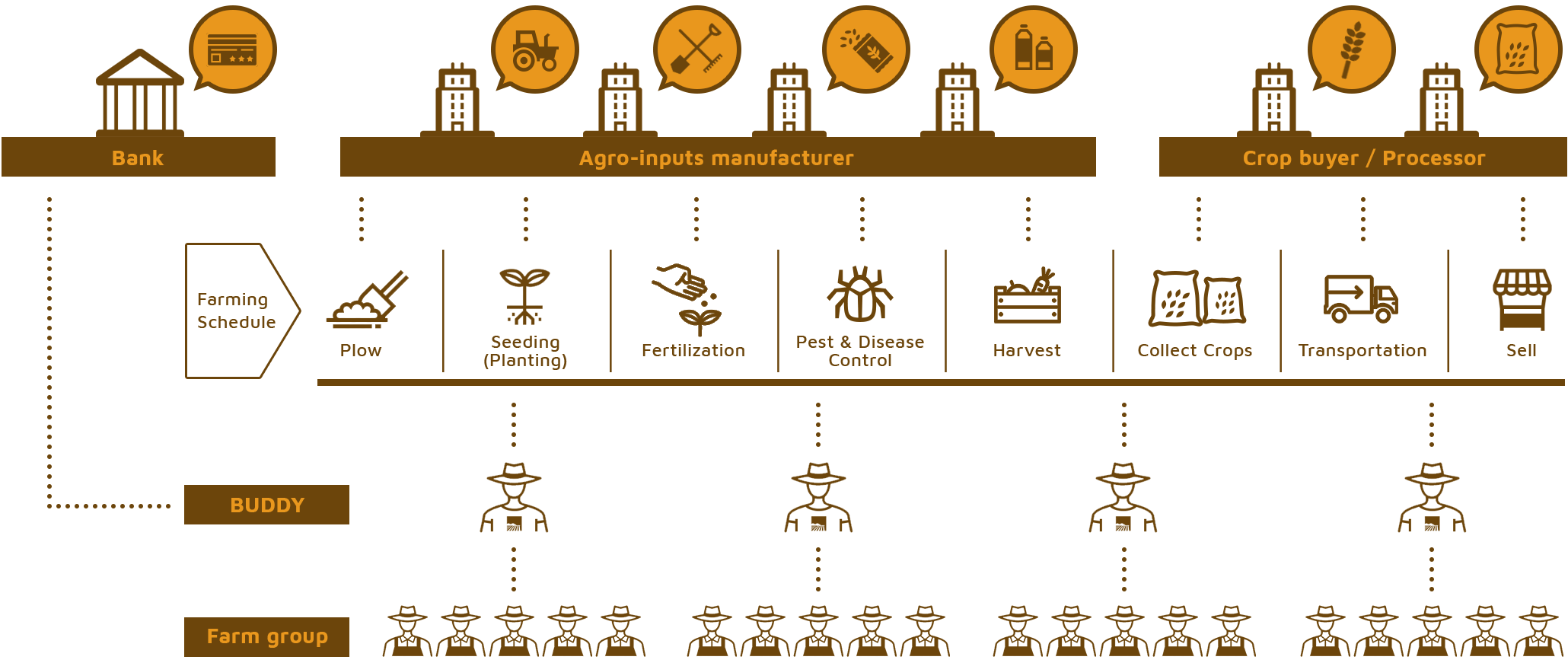

I started out as a Buddy and in my very first season I sold pesticides to 31 farmers and then to 88 farmers in the second. Having earned US$ 4,000 in one year, I wanted to help other farmers avail of the same opportunities. So, now I’m a Mentor with AGRIBUDDY, inducting and training other Buddies

- Hongseng Soy

Mentor・GOLD BUDDY

Income from AGRIBUDDY : US$4,948

My family lives in a remote area, where the cost of fertilizer is higher than other places, and too high for most farmers. As a Gold Buddy, I was able to buy and supply fertilizers at a lower price on credit. Our income was more than US$ 900 and I want to expand my activities more and earn more money for my family

- Phat Phan

GOLD BUDDY

Income from AGRIBUDDY : US$992

AGRIBUDDY enabled us to change our normally used pesticide to a more effective one and saved our crops.

- Kinjarapu Ramarao

India

AGRIBUDDY helped me to accurately measure the use of my tractor by farmers and completely eliminated my payment disputes.

- Pothsray Noch

Cambodia